In the competitive world of mergers and acquisitions (M&A), leveraging the right tools can make the difference between a successful deal and a missed opportunity. M&A Virtual Data Rooms (VDRs) have become indispensable in managing complex transactions efficiently. By understanding the strategic benefits of M&A VDR, businesses can maximize their deal success and streamline their transaction processes.

The Complete Lifecycle of M&A Transactions with VDRs

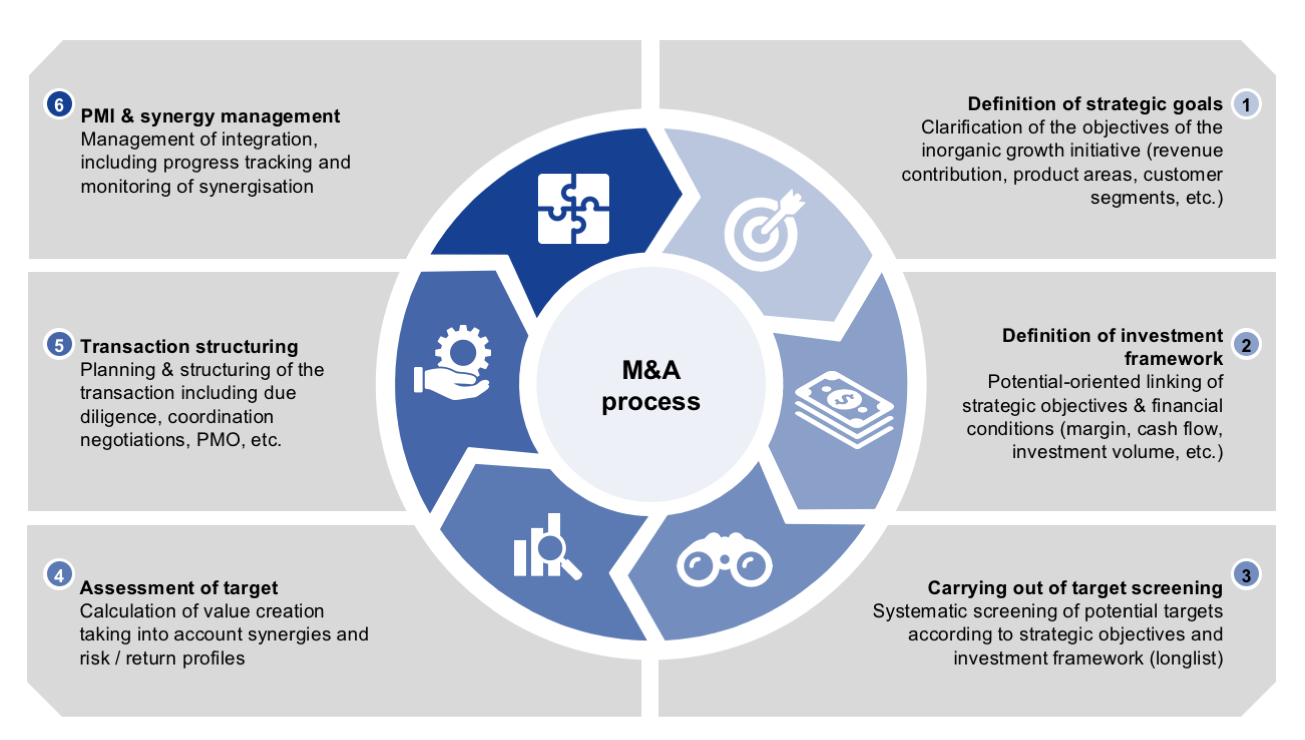

Navigating the transaction lifecycle of an M&A transaction involves several stages, from initial due diligence to final integration. M&A virtual data rooms play a crucial role throughout this lifecycle, offering benefits at each phase.

1. Preparation and Planning

Before the deal even begins, proper preparation is essential. M&A VDRs help in organizing and centralizing documents, making it easier for all parties involved to access relevant information quickly. This early organization ensures that potential issues are addressed before they become major obstacles.

2. Due Diligence

The due diligence phase is critical for identifying potential risks and validating the information provided. M&A VDRs facilitate secure document sharing, allowing multiple stakeholders to review and analyze documents simultaneously. This real-time access helps speed up the due diligence process and minimizes delays.

3. Negotiation and Execution

During negotiations, the ability to quickly share updated documents and track changes is crucial. M&A VDRs provide a secure environment for negotiating terms, storing updated agreements, and managing revisions. This centralized approach reduces the risk of errors and ensures that all parties are on the same page.

4. Integration and Post-Deal Management

After the deal is completed, integration is key to realizing the full value of the transaction. M&A VDRs continue to support post-deal activities by maintaining a repository of critical documents and facilitating ongoing communication between the merging entities. This ongoing support helps ensure a smooth transition and successful integration.

Navigating the transaction lifecycle in M&A deals requires careful management through various stages, from preparation to post-deal integration. M&A VDRs provide essential support throughout this process, enhancing document organization, facilitating secure sharing, and ensuring efficient communication. By leveraging these tools, businesses can streamline their transactions, reduce risks, and achieve smoother integrations.

Benefits of Using M&A VDRs for Different Stages of M&A Deals

The benefits of M&A VDRs extend across all deal stages of the deal, enhancing efficiency and security.

- Enhanced Security Features. Security is paramount in M&A transactions. M&A VDRs offer advanced encryption, multi-factor authentication, and detailed access controls to protect sensitive information. These features ensure that only authorized individuals can access critical documents, safeguarding against data breaches and unauthorized access.

- Improved Efficiency. M&A VDRs streamline the transaction process by automating routine tasks such as document management and access control. This automation reduces manual errors, accelerates document review, and enhances overall operational efficiency. With everything centralized in one platform, teams can focus on strategic decision-making rather than administrative tasks.

- Real-Time Collaboration. The ability to collaborate in real-time is a significant advantage of using M&A VDRs. Stakeholders can access, review, and discuss documents simultaneously, facilitating faster decision-making and reducing the time required to complete the deal. This real-time collaboration is especially valuable in fast-paced M&A environments where timing is critical.

- Comprehensive Reporting and Analytics. M&A VDRs provide detailed reporting and analytics capabilities that help track document access, user activity, and transaction progress. This transparency supports better decision-making and ensures compliance with regulatory requirements. Reports can also identify potential issues or bottlenecks in the transaction process, allowing for timely resolution.

By leveraging the benefits of M&A VDRs throughout the data room stages, businesses can maximize deal success and streamline their M&A processes.

Evaluating the Impact of M&A VDRs on Transaction Success

The impact of M&A VDRs on transaction success is significant. By improving security, efficiency, and collaboration, these tools contribute to a smoother and more successful transaction process.

- Success Metrics. Evaluating the effectiveness of an m&a vdr involves analyzing key metrics such as the speed of document access, the number of issues identified during due diligence, and the overall satisfaction of stakeholders. Success stories and case studies often highlight how VDRs have positively impacted specific deals by providing enhanced support and streamlined processes. M&A VDR evaluation plays a crucial role in understanding the transaction impact and determining how effectively the VDR contributes to deal success.

- Best Practices. To maximize the benefits of M&A VDRs, it’s essential to follow best practices. This includes selecting a VDR with robust security features, ensuring that all stakeholders are properly trained on using the platform, and regularly reviewing and updating the document repository. Implementing these best practices helps ensure that the VDR contributes effectively to the transaction’s success.

M&A Virtual Data Rooms (VDRs) have a significant transaction impact by enhancing security, efficiency, and collaboration throughout the deal process. To evaluate their effectiveness, it’s crucial to analyze metrics such as document access speed and stakeholder satisfaction. Success in using VDRs is linked to proper M&A VDR evaluation and adherence to best practices, which collectively drive deal success. For a deeper understanding of how data rooms function in M&A processes, watch this video.

Leveraging the right M&A VDR can transform your transaction management processes, leading to greater efficiency, enhanced security, and ultimately, more successful deals.